Government predicts debt to rise by over $14 trillion

Projections raise possibility of serious financial crisis

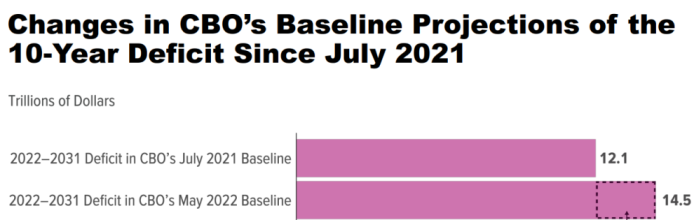

The Congressional Budget Office (CBO) just announced that the national debt would be $2.4 trillion higher than they’d previously said. Over the next 10 years, the national government is likely to borrow $14.5 trillion. This raises the issue of sustainability. Other nations have suffered debt crises in the past, even with lower levels of debt, and that includes developed countries. It is not clear that America will be able to make the interest payments on this debt.

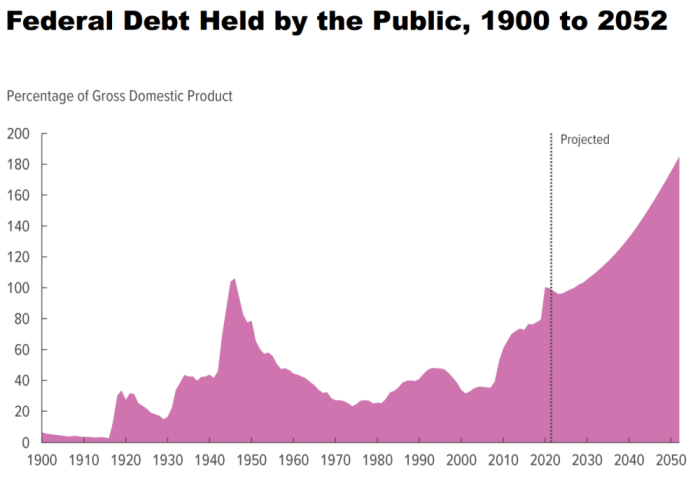

Currently, the national debt stands at about 125% of GDP. That exceeds the level seen by several of the countries involved prior to the European debt crisis, when markets eventually spiked interest rates to reflect the very real risk of default. Only bailouts from other European countries was able to forestall default, but which financial entity would be of adequate scale to bail the U.S. out?

The projection below shows how rapidly debt will rise compared to the underlying economy, which sustains the ability to pay that debt:

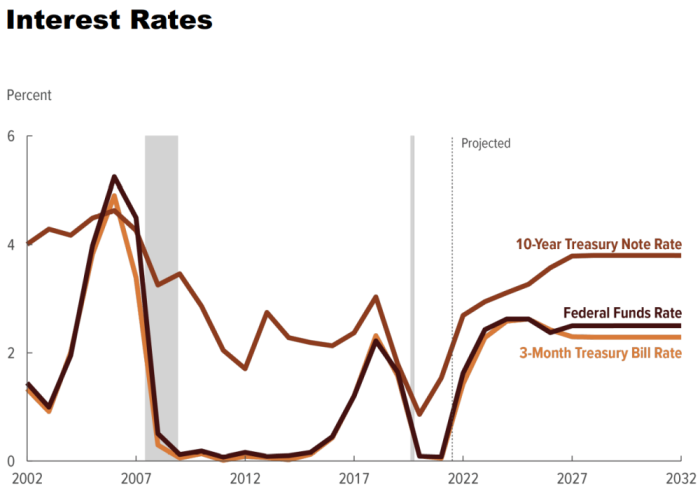

Generally, crises are triggered when debt service payments get too high. In other words, just like with individuals, it’s not the overall debt level which triggers the crisis, but rather the monthly payment obligation. Of course these two factors are related: the higher the debt, generally the higher the payments. However, there is another factor: the interest rate. For example, during the housing crisis in 2008, one of the major triggers was when adjustable rate mortgages began to move upwards. That’s when borrowers started to default.

The new report predicts something similar for the national debt: rising interest rates.

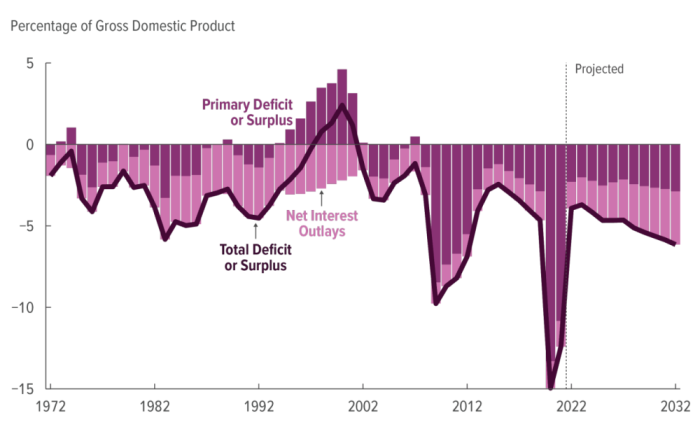

The chart above shows what the CBO admits, “The interest rate on 10-year Treasury notes is expected to increase through 2028.” As a result of this predicted hike in interest rates, the fastest growing portion of the deficit will shortly become interest on the debt. The dark purple areas below represent the portion of the deficit not due to interest, and the lighter purple represents the portion due to interest. It shows the U.S. falling into the hole of not just borrowing to buy goods and services, but also borrowing to pay the interest on past borrowing.

What's even worse is that this interest rate projection is very optimistic. It depends on inflation ending soon, even though market expectations are not showing a large drop in inflation over the next five or 10 years, and the excessive money supply creation of the past decade is likely to be inflationary for longer than a year or two. The projections by the CBO assume that interest rates never return to normal levels. They remain below 4% throughout the next 10 years of the projection. That’s lower than the historic average.

Even if it were possible to keep interest rates below normal for another 10 years, the only way to do it would be to continue to use the central bank to create new money supply and use it to push interest rates down. Such an action is inflationary. In other words, in order to avoid the sort of default crisis which other nations have suffered in modern times, the central bank would have to continue to follow inflationary policies. It seems that the U.S. government may well have to choose between default triggering a debt crisis, or debasement triggering a currency crisis.

Jerry Bowyer is financial economist, president of Bowyer Research, and author of “The Maker Versus the Takers: What Jesus Really Said About Social Justice and Economics.”