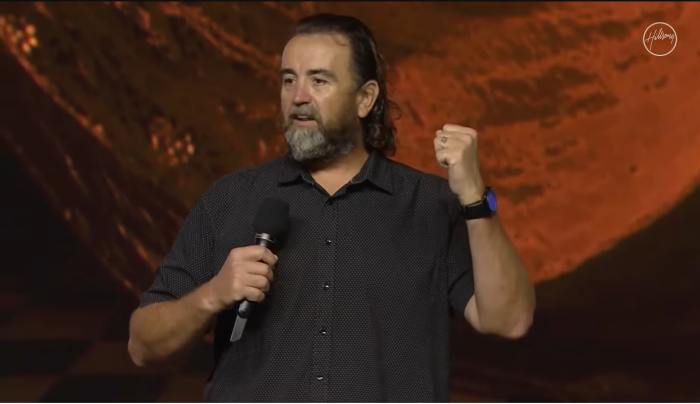

Hillsong Church’s Darren Kitto claimed $50K in annual pool costs as part of $125K housing allowance: report

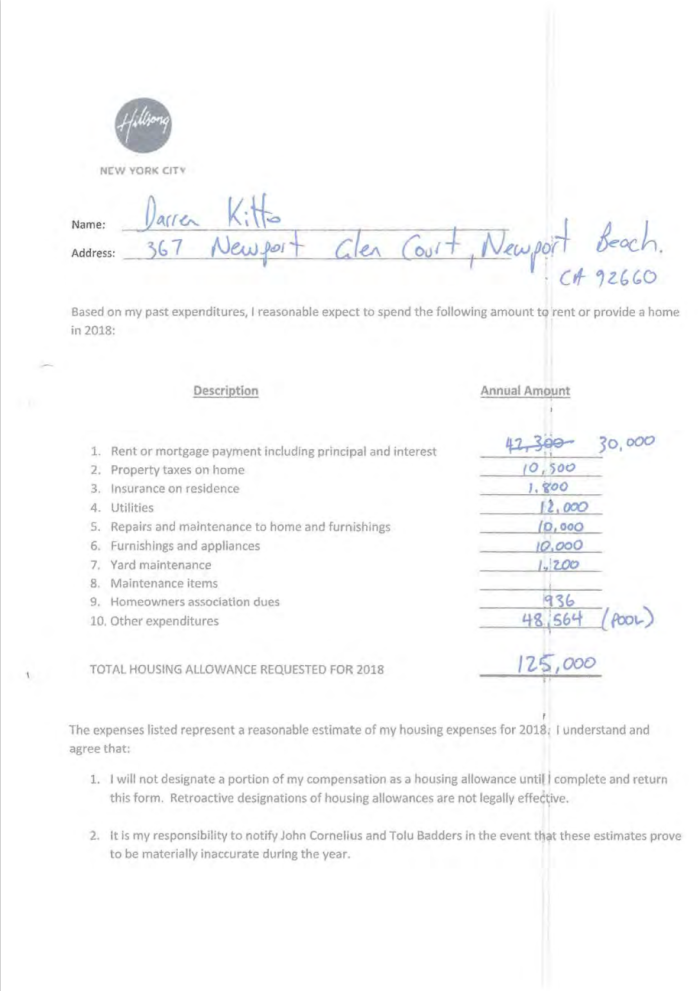

Hillsong Church’s International Ministry Director Darren Kitto claimed he would need to cover nearly $50,000 in pool expenses in 2018 as part of a $125,000 housing allowance for a Newport Beach, California, home he purchased in the Santa Ana Heights neighborhood for $1.85 million that features a “portable spa.”

The details on Kitto’s housing allowance claim for 2018 were highlighted in a trove of documents first made public on March 9 by Andrew Wilkie, an independent member of the Australian Parliament, thanks to the work of a whistleblower.

Citing the information from the documents, Wilkie accused that Hillsong Church founder Brian Houston and other leaders, including the newly appointed Global Senior Pastor Phil Dooley, of tax evasion and shopping sprees that would “embarrass a Kardashian.”

However, a forensic review of Hillsong Church’s finances by accounting firm Grant Thornton has since concluded that allegations Hillsong Church or its personnel engaged in “unlawful conduct” are not supported by the documents. Attorneys for the church say allegations that funds were misappropriated reflect a “misunderstanding” that should be discussed in a “church context.”

It was unclear what the exact pool costs, which amounted to $48,564, entailed. Calls made by The Christian Post to Hillsong representatives in New York City where the claim was submitted went unanswered.

According to Home Guide, “pool maintenance costs $122 per month or about $1,400 per year on average.” Annual maintenance costs for a portable spa or hot tub are about $600.

Kitto’s home, purchased in 2017, features four bedrooms and three bathrooms covering just under 3,500 square feet of space, according to Compass. Listed among the home’s contemporary amenities are a “portable spa and fire pit.”

Photos of the home on Compass, which did not include a “pool,” show what appears to be a small portable spa on the outside of the house.

On the claim form, Kitto wrote: “The expenses listed represent a reasonable estimate of my housing expenses for 2018. I understand and agree that: 1) I will not designate a portion of my compensation as a housing allowance until I complete and return this form. Retroactive designations of housing allowances are not legally effective.”

According to the Internal Revenue Service, if a minister receives as part of their salary “an amount officially designated (in advance of payment) as a housing allowance, and the amount isn’t more than reasonable pay for your services,” it can be excluded from gross income. If the advance payment is more than the actual cost of housing, only the lesser amount should be legally claimed as housing allowance.

Kitto acknowledges on the claim form that he is responsible for notifying Tolu Badders, Hillsong East's CEO and executive pastor, as well as another church official, John Cornelius, “in the event that these estimates prove to be materially inaccurate during the year.”

The 2018 claim form shows a correction in the amount claimed for “rent or mortgage payment including principal and interest” from $42,300 for the year to $30,000.

According to Coastal Real Estate Group, “Santa Ana Heights is a community within Orange County zoned for more moderate income families, which provides for less expensive housing than in the coastal neighborhoods of Newport Beach.”

The real estate company notes that a five bedroom, five bathroom home in the neighborhood with 3,000 to 4,000 square feet of space usually costs $1.4 million.

Kitto, who has worked as a pastor at Hillsong Church since 1996, oversees Hillsong Channel, Hillsong TV, Hillsong Family, Hillsong Leadership Network and Hillsong’s Aid and Development and Disaster Relief initiatives. He lives in the home now valued at $2,764,129, according to Redfin, with his wife and four children.

Global Online Lead Pastor of Hillsong Church Benjamin Houston also claimed $107,241.96 of his $176,857 salary in 2018 as housing allowance which made his adjusted annual gross salary for that year $69,617.

Communication highlighted in the documents shows there were multiple concerns about how much Hillsong employees were claiming for housing allowance and how they were reflecting their earnings to the IRS.

In one email, for example, Hillsong employee Jason Strong said Hillsong employees like Brooke Ligertwood and Joel Houston had housing costs that were higher than the income they claimed they were earning on the W-2 forms.

“Can they claim it all as housing considering they earn income elsewhere (royalties, distributions etc.),” Strong wrote.

Strong was advised in an email response that “Ultimately, the housing should be less than the salary.”

It was noted by Strong that both Ligertwood and Houston both “receive 1099 income for performance and producing record.”

“This income is paid from Hillsong Music – there (sic) W2 Employment is Hillsong Church – there have been some comments about receiving both W2 and 1099 income from the same group ‘Hillsong’ I believe their job (W2) and their 1099 – IP is different, but would you have any comments on this?” he asked the employee identified as Bri and the initials BKD.

“If the same federal EIN would be used for issuing both the Form W-2 and Form 1099 in the same calendar year, there could be some concern and it would need to be looked at more,” Bri responded.

“Obviously, the minister’s earnings should be Form W-2,” she added. “The positions are completely different, and as long as you have looked at the rules for independent consultant versus employee and feel comfortable the performance and producing record is fine with an independent consultant relationship, then there should be a low risk of doing it this way. Normally, we would expect to see all income on the W-2, however in some instances we do see it reported separately on the W-2 and 1099-MISC.”

Contact: leonardo.blair@christianpost.com Follow Leonardo Blair on Twitter: @leoblair Follow Leonardo Blair on Facebook: LeoBlairChristianPost