How Christians should think about inflation and investing

Investing is a part of modern life. As the rise in inflation has made clear, without investing, it's very hard to keep up with the debasement of fiat money.

Investing is not an easy endeavor. Wealth management is a big business because so many people are reluctant to deal with the minutiae of portfolio management. For Christians, figuring out what to do with the money we have is not easy. Should we be donating it? Should we be making more money with it? What's a Biblical investment and what's not? Should we be investing at all?

The temptation is to just absorb the advice of financial experts. Of course, I'm calling it a temptation for a reason: following the ways of the world without analyzing its moral consequences is generally a recipe for falling into sin. If we are to invest, we must do so in a way consistent with the teachings of our Lord.

How should Christians think about investing? What are the assumptions of the financial experts and how do we evaluate them from our worldview? In this article I seek to answer this question, particularly the worldview around the current investing landscape.

Investment from a secular perspective brings in a host of assumptions, many of which are, to put it mildly, confused. To really understand the current situation, we need to go back to first principles and look at money. We don't understand money. We may think we do because it's such a large part of how we live. We use money often, but few people know how money comes into existence, the role of money in economics, or even what a central bank is. The ignorance that most people have toward money is not an accident. To paraphrase Henry Ford, if people knew, there would be riots tomorrow.

What is money? Money is the most tradeable good in the economy that people use as a store of value, medium of exchange, and unit of account. In particular, money is a hedge against future uncertainty because it can be traded for everything else. This is why people keep cash around: because if they knew everything that was going to happen, they would put all their money to work, as they say.

The money that we invest is money we don't anticipate needing. If, for example, you have $1,000 and need it to pay rent next week, it would be foolish and imprudent to invest that money, which locks it up for a year. In the parable of the talents, for example, the master does not give the servants money that he needed for his journey, but money that he didn't need or anticipate needing during the journey. Investment is what we do with excess money beyond the needs that we have. The principle is that we only invest money we don't need for the foreseeable future.

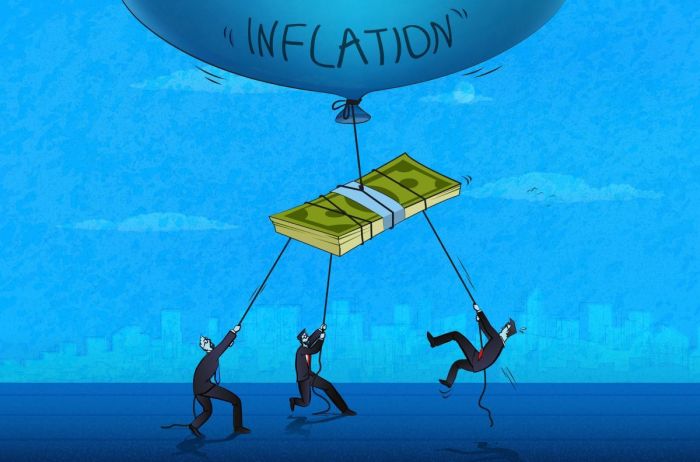

The current monetary system we live in has a fluctuating monetary supply. The supply of money expands through the issuance of new loans, but also contracts with default of loans or the repayment of loans. The expansion of the money supply is what we call inflation, and it adds many perverse incentives. One major incentive is that money generally becomes less valuable over time. Practically, this means everything gets more expensive. This has been generally true over the past 80 years or so and that means our money is something like a melting ice cube. Keeping dollars over any significant amount of time reduces its value, meaning keeping it around is costly.

A lot of "investment" today is an attempt to keep up with inflation. It's not money that's in excess of need, but a way to avoid the bad effects of inflation. The current monetary system incentivizes "investment" because fiat money does such a poor job of holding value over the long term. Thus, nearly everyone with any money "invests" whether there's an anticipated need or not.

The root cause is because the value of the money is being stolen, and people generally will avoid storing anything where thieves steal. All government currency like USD, EUR, JPY, and others, have this property where the value of the money decreases as the respective central banks expand the supply. This has been more obvious the past few years, but it's much more obvious outside the western world, in developing countries.

In places like Turkey or Argentina or Nigeria, the local currency loses value quickly and "investment" in the sense of avoiding theft is a necessity to survive. This is not investment in the Biblical sense; the investment in another asset is really a search for better money.

Our money is bad. The time period where we can anticipate needs gets shorter and shorter as money loses value. It's very difficult to plan even a month ahead in Venezuela, for example, because the Bolivar loses value so quickly. Venezuelans are not "investing" excess money, but looking for another money altogether because they can't anticipate needs any other way. USD isn't nearly as bad as the Venezuelan Bolivar or even the Turkish Lira or the Nigerian Naira. But USD does have this property where anticipating needs becomes harder due to the continuing debasement of the money.

As Christians, we need to think about these two types of investment. Are we investing money in excess of our needs, or are we "investing" because we don't want to get robbed by inflation?

In the next article, I'll explore what a better money would look like, and will make the case that Bitcoin is that money.

Jimmy Song is a Bitcoin developer, educator and entrepreneur. He's a programmer with over 20 years experience, an open source contributor to many different Bitcoin projects and the author of Programming Bitcoin from O'Reilly, The Little Bitcoin Book, Thank God for Bitcoin and BItcoin and the American Dream. Jimmy has been a lecturer at the University of Texas, an expert witness in legal cases involving Bitcoin and is an advisor to multiple companies. Jimmy writes a weekly newsletter, Bitcoin Tech Talk and has a podcast Bitcoin Fixes This.