Huntsman's Jobs Plan Highlights Tax Reform

Moving ahead of his Republican rivals and President Obama, GOP presidential contender Jon Huntsman Jr. announced his version of a jobs plan Wednesday that promises to simplify the tax code.

Huntsman delivered his economic plan titled, "Time to Compete: An American Jobs Plan," at Gilchrist Metal Fabricating, a New Hampshire plant. Economists praised the plan as a potential boon for the economy. The announcement's New Hampshire location shows that the former ambassador is trying to make in-roads in the Granite state.

The plan, which his campaign disclosed on its website, featured a massive tax overhaul.

"Over the last few decades, our tax code has devolved into a maze of special-interest carve-outs, loopholes and temporary provisions that cost taxpayers more than $400 billion a year to comply with," said Huntsman in his announcement.

Huntsman’s plan streamlines the business tax code by eliminating the alternative minimum, capital gains and dividends taxes. Those taxes, he stated, penalize families and businesses and hampers investments. His plan would also reduce the corporate tax from 35 percent to 25 percent to help make America competitive in the global market.

The plan also simplifies personal income taxes by cutting all deductions and credits. Huntsman also consolidates the code down to three individual tax brackets – 8, 14 and 23 percent.

William McBride, an economist with the nonpartisan educational organization the Tax Foundation, said of the 23 percent top marginal tax rate, "We haven't seen that rate basically ... in decades. This would be a big increase in the GDP."

GDP, better known as gross domestic product, is the market value of all final goods and services produced in the country and is the principal measure for economic growth.

Citing a 2006 treasury study, McBride said, "The component that contribute[s] most to growth [is] reducing the top marginal rate."

McBride said of Huntsman's plan, "Lower tax rates like he's proposing would help a lot in moving towards a high-growth trajectory."

If implemented, McBride said, business would likely begin hiring and bringing their office back to the United States.

Reuters Money and Politics blogger James Pethokoukis praises the plan as "the most pro-growth, pro-market tax plan put forward by a major U.S. president candidate since Ronald Reagan in 1980."

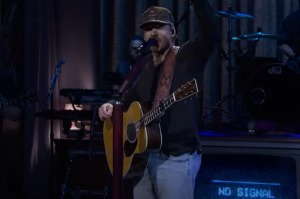

In a precursor YouTube video, Huntsman announced that the plan is a product of his leadership as Utah's former governor.

"In Utah we wanted to make our marketplace a little more inspiring. So we came up with a ten-point plan for economic revitalization," he said. "It started with tax reform, flattening the rate, simplifying things, we took much of the sales tax off food. We did regulatory reform, we kind of looked at the marketplace to see how we could improve and streamline the way in which business decisions were made."

Utah attained an "A" grade in 2007 from The Pew Center on the States during Huntsman's 2005-2009 tenure as governor. Texas, which was under the leadership of Republican presidential candidate Rick Perry in 2007, received a "B+" grade.

Despite his praiseworthy plan, Huntsman still trails his opponents in the polls. Gallup polls show he is currently in last place with 1 percent of Republican voters surveyed.