Triggering a recession is not the way to fight inflation

It's important to remember that the Fed holds to a distorted form of economic philosophy which wrongly thinks there is a trade-off between inflation and recession.

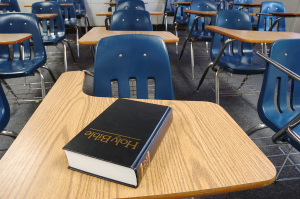

Biblical precepts call for human beings to fill the Earth and subdue it (meaning economic growth), and for just weights and measures (meaning no inflation). Modern economics, especially those associated with the atheist rejection of classical economics by John Maynard Keynes, rejects those precepts. It believes that you fight recessions with inflation.

That's why, in 2020, the government launched a policy of "monetary stimulus." The government injected money into the economy, discouraging savings through inflation. That's a pro-inflation policy, but what happens when it works and then inflation comes? The policy is typically reversed, and money is pulled out of markets to slow the economy. That's a pro-recession policy, and that's the phase we're in now.

Let's clarify what we mean by pro-recession. There is a pro-recession/anti-inflation faction. That faction believes that inflation is caused by excess growth, which is described often as "overheating," as if the economy were like the motor of a car which heats up at high speeds. That faction, therefore, believes that the Fed must slow down the economy to fight inflation in order to (as one former Fed chairman said) "take away the punch bowl once the party gets to be too much fun."

Of course, when the Fed intentionally slows down the economy, it knows that it's risking a recession. Historically when the Fed has engaged in punch bowl removal tactics, it has generally led to recession. So of course they know that monetary tightening is reasonably likely to lead to a recession. In fact, in an interview with Bloomberg last week, the head of the Cleveland Fed explicitly said that the goal of Fed policy was to slow the economy and raise the unemployment rate. Though she herself was not forecasting a recession, she clearly knew it was a possibility. Markets are acting as though a recession is coming, and surveys of economists have been saying the same thing. The hawkish wing would never say it explicitly, but their policy is indeed pro-recession.

Since the Fed is by far the largest actor in U.S. financial markets, and no other single actor is even close in scale to the Fed's $10 trillion portfolio of financial assets, when the Fed speaks, markets listen.

This week the Fed both spoke and acted. It "raised the interest rate" by 0.5%. Of course, as we've explained before, the actual mechanism of the process is that the Fed buys bonds, keeps them, or sells them. So "raising rates" really means selling bonds. When the Fed buys bonds, it typically creates a new money supply and uses that money to buy bonds from banks. When the Fed sells bonds, it takes the proceeds of those sales and typically erases them from existence, thereby shrinking the money supply. The change in interest rates is a by-product of that transaction.

The Fed's announcement this week was no surprise: markets already knew that was going to happen and therefore didn't react much to it. The new information was data released after the meeting that revealed what Fed members thought future policy would be. The data, known as the "dot plot" is what the members of the Fed predict the Fed as a whole will do.

One can ask an individual member of the Fed what they want to do, and that reveals some information, but the dot plot taps into the Fed members' experience from talking to other members of the committee (and staff members) by asking them to synthesize that data and predict what the outcome will be. The dot plot revealed that members were predicting that future hikes would be higher and stay high longer than markets have previously believed.

That showed that the members themselves see that the pro-recession faction is growing more powerful.

Every day, information is evaluated by markets, which ask, "Does the data strengthen the inflation faction or the recession faction?" Last week, investors continued the shift toward the thesis of a rising recession faction, so they moved closer to pricing in a future recession and a partial victory against inflation.

In response to the dot plot shift, the typical hawk (i.e. the recession faction) pattern of trading occurred:

- The futures market shifter slighted toward expectations of bigger hikes.

- The CME (Chicago Mercantile Exchange) Fed Watch Tool shifted in such a way as to imply that if the predictions of future hikes turned out to be wrong, the hikes would more likely be larger than expected rather than smaller.

- The dollar rose, at least according to some dollar indices.

- Gold fell.

- Inflation hedges lagged non-inflation hedged investments.

- Markets in general fell.

Often a shift in expectations about future Fed actions creates a shift in growth expectations. If there is a shift toward belief the Fed is going to tighten, that goes along with anti-growth trades. Markets surmise that monetary tightening might shrink the economy. That's because hawkish policy is designed to slow the economy to fight inflation.

Last week followed that anti-growth playbook:

- Stocks were negative.

- Bonds were positive.

- Which means stocks significantly lagged bonds.

- The dollar rose, at least according to some measures.

- Copper fell.

So, last week fit the hawk flight pattern, and the trades between asset classes (stocks vs. bonds vs. commodities vs. real estate vs. currencies), saw that as tilting the U.S. toward recession.

As we shall see in the detail below, the hawkish pattern also appeared in the comparative returns within asset classes (e.g. one sector of stocks vs. another; one class of bonds vs. another, etc.). And the variations between sectors sent pessimistic signals about growth.

Next week, there will be a lot of housing market data as well as the Fed's favorite inflation measurement.

Bond Market, Last Week: Stocks significantly underperformed bonds, which constitutes an anti-growth signal. In addition, variations between the different types of bonds were generally sending anti-growth and anti-inflation signals.

Bond markets were generally down last week, which fits the narrative of a tougher Fed. After all, if the Fed is going to be selling more bonds (or at the very least buying fewer bonds), it's no surprise for bond investors to see that as bad news for that asset class. The macro-economic implications of that expected shift in policy become clearer by taking a higher-resolution look at the data, turning the magnification level up to see how different types of bonds reacted.

Treasury bonds, the ultimate safety play, overperformed high-credit-quality corporate bonds, which are considered a little riskier. Low-credit-quality corporate bonds lagged high-credit-quality ones. So the riskier the bonds, the worse the performance.

That makes sense when recession risks are seen as rising: when business slows down, companies find it harder to make their debt payments, but the government can always tax or print more. So, corporate bonds are more likely to default and forward-looking investors sell them now rather than risk being left holding the bag if a company defaults on its debt service payments. Last week, markets acted as though growth might not be high enough for well-financed corporations to make those payments. That's called 'risk off.'

Switching from the growth to the inflation topic, inflation-protected securities performed poorly compared to their non-inflation protected alternatives. That implies less fear of inflation. Because if investors sell inflation hedges more aggressively than the alternatives, it is logical to consider it likely they are less worried about inflation. That also fits the hawk/recession trade: if the Fed revs up the fight against inflation, we'll probably get less inflation.

Real Estate, Last Week: REITS performed negatively. REITs have a slight tendency to perform between stocks and bonds, because real estate has some of the characteristics of stocks (such as a growth upside), and some of the characteristics of bonds in that the income source for real estate is leases and leases are bond-like, involving fixed payments. Last week REITs were closer to stock performance than to bonds, which is also consistent with an anti-growth trading pattern.

U.S. Stock Markets, Last Week: Domestic equity markets were generally down last week, but not equally so. Growth stocks lagged value stocks across two of the three size categories.

Growth tends to beat value when growth expectations are rising, because low growth presumably makes it harder for earnings to actually deliver on growth companies' high expectations. So, the weak growth performance is consistent with the anti-growth trades. That is indeed likely, because the pattern last week showed a pretty consistent anti-growth signal.

On the other hand, the weak performance of growth stocks might have been driven by rising interest rates. Growth stocks are more dependent on low interest rates than value stocks, so consequently, they also tend to underperform value stocks when interest rate expectations are rising. Their long time horizon causes the discounting effect of interest rates to play out over a longer period of expected future earnings. Whatever the interest rate expectations, whether higher or lower, they tend to have a larger effect when it is applied over a more years of discounting. Since growth stocks prices are based on a longer time horizon, they tend to fluctuate more in response to interest rate expectations about the future.

The value-expanding effect of low rates helps companies whose investment premise is based on the long view more than those whose investment premise is based on the short view. Since last week was about a shift toward higher rate expectations, it's no surprise that growth lagged value. That's what basic theory and history would teach us to expect.

It's honestly hard to know how much last week's growth-vs.-value performance was about the Fed changing the valuation of stocks by changing the interest rate, or about the Fed triggering a recession. Causing a recession implies future cash flows will be lower. Raising interest rates means that future cash flows will be discounted more deeply. Both of those things hit growth stocks.

But if one looks at the difference in performance between different stock sectors: S&P/NASDAQ, cyclical/defensive, discretionary/staples, and discretionary/utilities, one sees a pretty consistent anti-growth trade. Plus, last week interest rate expectations did not rise consistently. All this suggests domestic stock performance last week is more about the rising probability of a recession than it is about the discounting effects of rising rates. In other words, it's more a recession warning.

International Stock Markets, Last Week: International equity markets were mixed for the week. In general, U.S. was on par with global markets in price returns. The dollar was mixed depending on which basket of currencies it is compared to.

In addition, developed markets were generally less negative than emerging markets were. EM tends to be more sensitive to rising US rates, as capital flows to places where it can get a higher yield and EM is more volatile and therefore more vulnerable to such outflows.

The problem with the direction in which our leaders are taking us is that it is fighting inflation with its monetary policy but not fighting recession with its tax and regulatory policy. The answer to slow growth and high inflation is not to push growth even lower. It is to fight both problems with the proper tools: fight inflation by removing excess money and fight recession with pro-growth tax and spending cuts. What our leaders are doing is giving us the pain of monetary contraction, without the relief of economic expansion.

Jerry Bowyer is financial economist, president of Bowyer Research, and author of “The Maker Versus the Takers: What Jesus Really Said About Social Justice and Economics.”